Every so often I review articles from Renewable.EnergyWorld.com. The following are worthy of mention from their latest issue:

As reported by Jennifer Runyon, managing editor of Renewable Energy World, the U.S. Solar Energy Industries Association (SEIA) reported that solar is the fastest growing energy source in the country. More than 3,300 MW of solar capacity was added last year, an increase of 76% over 2011. The market size is now $11.5 billion, a third larger than what it was in 2011.

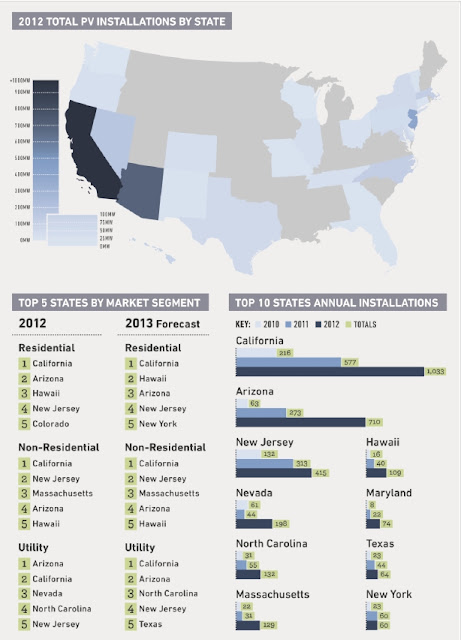

Solar photovoltaics capacity, now at 7,200 MW, should top 10,000 MW (the equivalent of ten nuclear power plants) by the end of the year. Homes this past year accounted for 488 MW, commercial installations another 1,040 MW and large-scale utility added 1,780 MW, a 134% increase from 2011. The State of California grew by 1,033 MW, best in the nation. The grand PV summary:

Brightsource Energy's 392 MW concentrating solar power (CSP) farm at Ivanpah in California will come online this year. Abengoa's CSP Solana Generating Station in Arizona of 280 MW will also become operational this year:

Remarkably, the installed price of all these solar facilities declined by 26.6% in 2012, now down to $3.01/watt. Residential solar systems remains the highest, still at $5.04/watt, but utility scale prices dropped to $2.27/watt at the end of the year. China is not now a problem because of tariffs up to 35%.

The future also looks good, as 4,300 MW of PV will be installed this year, a 29% growth in the U.S. World PV demand will rise 7% to 31,000 MW, with China becoming #1 to Germany #2:

Why this change? Europe has reduced incentives, while Asia is enhancing solar purchase inducements. The global market is now, though, shifting to the Middle East, Africa, Latin America, Southeast Asia and the Caribbean, for these emerging regions will double their solar capacity by 2017.

2. Hate to have this blog so long on a Friday, but my previous posting about biomass was not favorable, so, as reported by Tildy Bayar, Associate Editor of Renewable Energy World:

Biomass To More Than Triple Globally by 2030

Again, though, first, the bad news is that an area the size of Russia would be required to replace all the oil used today. So, temper down your expectations. But, according to Lux Research, when cellulosic systems become commercial, bioenergy should boom. (My concern is that I don't think fermentation is the right pathway. The gasification of biomass into methanol, if the direct methanol fuel cell can be perfected, is the way to go.)

Anyway, Lux surmises that one billion metric tons of biomass/year, which currently replaces 3% of total petroleum products, should jump to 3.7 BMT/Y by 2030 (so the headline could just as well have said "quadruple"). Not bad, actually...if cellulosic ethanol and other biofuels can be, according to this analysis, commercialized. Of course, if oil jumps to $200/barrel, even I can predict that biomass will prevail. Read the article. It's a positive. My problem is that I personally have a bone to pick about our national biofuels policy.

3. This all seems to get better for biomass, as:

What Do Struggling Gas-Fired Plants Mean for Renewables?

This report indicates that there is now overcapacity in Europe, and coal powerplants...yes, electricity from coal...are prevailing over natural gas. Biomass is not really a player in this discussion. One comment by Davis Swan at the end of this article is particularly telling:

This report indicates that there is now overcapacity in Europe, and coal powerplants...yes, electricity from coal...are prevailing over natural gas. Biomass is not really a player in this discussion. One comment by Davis Swan at the end of this article is particularly telling:What most green energy advocates don't seem to understand is that renewables ONLY work today because all the thermal generation assets (coal, gas, and nuclear plants) are still running, providing on-demand backup power. But preferential treatment for renewables is utterly destroying the economics of running these plants so that they will, in the end, be shut down. At that point we will be reliant upon unreliable renewables and there will be major grid failures. That in turn will lead to a backlash from the general public against renewables.

So the good news? about solar and biomass actually turned out to, again, be spotty for the latter. But that is the nature of any unconventional option. Should we abandon biomass? Of course not. While timing is a scary unknown driven by the price of oil and global warming, government needs to, with good judgement, pursue a course that balances competitiveness with environmental imperatives.

-

The ten day bull run of the Dow Jones Industrials ended today, the longest in 17 years. The all-time high was yesterday at 14,539, which was broken seven days in a row for the first time ever. Ten straight days of increase have now occurred 21 times in the 117-year history of the Dow, jumping 122% since the 5March2009 low of 6547. The S&P 500 index got close to its all time high of 1565 in October 2007, but could not quite pull it off:

-

The ten day bull run of the Dow Jones Industrials ended today, the longest in 17 years. The all-time high was yesterday at 14,539, which was broken seven days in a row for the first time ever. Ten straight days of increase have now occurred 21 times in the 117-year history of the Dow, jumping 122% since the 5March2009 low of 6547. The S&P 500 index got close to its all time high of 1565 in October 2007, but could not quite pull it off:

0 comments:

Post a Comment